Understanding Business Start-Up Loans

What are Business Start-Up Loans?

Types of Business Start-Up Loans

- Traditional Bank Loans: These are loans provided by banks and credit unions. They typically offer competitive interest rates but may have stringent eligibility criteria.

- SBA (Small Business Administration) Loans: These are government-backed loans that offer favorable terms and lower interest rates. They are administered by approved lenders and come with specific requirements.

- Online Lenders: Online lending platforms have become popular for their quick approval process and accessibility. They may have slightly higher interest rates but offer more flexibility.

- Personal Loans: Entrepreneurs can use personal loans to fund their business start-up. However, this option may carry higher interest rates and personal liability.

- Venture Capital and Angel Investors: While not loans in the traditional sense, venture capital and angel investors provide funding in exchange for equity ownership in the business.

Advantages of Business Start-Up Loans

- Immediate Access to Capital: Business start-up loans provide entrepreneurs with the funds they need to get their business up and running.

- Maintain Ownership: Unlike seeking investors, taking out a loan allows you to retain full ownership of your business.

- Build Credit: Successfully managing a business loan can positively impact your credit score, making it easier to secure financing in the future.

- Tax Benefits: The interest paid on business loans is often tax-deductible, providing potential financial benefits.

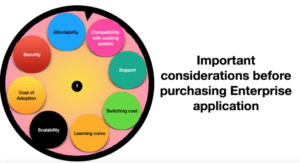

Considerations Before Applying

Business Plan

- A well-structured business plan is crucial when applying for a start-up loan. It should outline your business concept, market analysis, financial projections, and operational plan.

Creditworthiness

- Lenders will assess your credit score to evaluate your eligibility for a loan. A higher credit score increases your chances of approval and can lead to more favorable terms.

Collateral

- Some loans may require collateral, such as personal assets, to secure the financing. Be prepared to offer assets as security for the loan.

Legal Structure

- Determine the legal structure of your business as it can impact your eligibility for certain types of loans.

How to Apply for Business Start

- Research Lenders: Compare different lenders to find the one that best suits your needs in terms of interest rates, terms, and eligibility criteria.

- Gather Documentation: Prepare all necessary documents, including your business plan, financial statements, personal and business tax returns, and any other relevant information.

- Submit Application: Complete the application process with the chosen lender, ensuring all required documents are included.

- Review and Negotiate Terms: Once you receive offers, carefully review the terms, including interest rates, repayment terms, and any associated fees. Negotiate if necessary.

- Accept and Use Funds: After finalizing the terms, accept the loan offer and use the funds for your business needs.

Business start-up loans can be a vital resource for aspiring entrepreneurs looking to turn their business dreams into reality. By understanding the types of loans available, considering important factors, and following the application process, you can secure the funding needed to launch and grow your business successfully. Remember to choose the right loan for your specific needs and always borrow responsibly. Good luck on your entrepreneurial journey!