In the realm of business, choosing the right entity type is a crucial decision that can significantly impact the success and longevity of your venture. Among the many options available, Delaware stands out as a popular choice for establishing businesses, thanks to its business-friendly regulations and advantageous tax structure. However, before you dive headfirst into the world of Delaware business entities, it’s essential to conduct a thorough Delaware Business Entity Search.

Understanding the Importance of Delaware Business Entity Search

Conducting a Delaware Business Entity Search is a pivotal step in the process of establishing a business in the state. This search allows you to explore the existing business landscape, ensuring that your chosen business name is unique and not already in use. It’s also a vital step in ensuring compliance with state regulations.

The Process of Conducting a Delaware Business Entity Search

To perform a Delaware Business Entity Search, follow these steps:

- Access the Delaware Division of Corporations Website: Begin by visiting the official website of the Delaware Division of Corporations.

- Navigate to the Business Entity Search Page: Once on the website, locate and click on the “Business Entity Search” option. This will typically be prominently displayed on the homepage.

- Enter Your Desired Business Name: In the search field provided, enter the business name you have in mind. It’s recommended to have a few backup names prepared in case your first choice is unavailable.

- Review the Results: The search results will display a list of businesses with names similar to the one you entered. Take the time to carefully review these results.

- Check for Availability: Ensure that the exact name you desire for your business is not already in use. If the name is available, you can proceed with confidence.

Why Delaware for Business Formation?

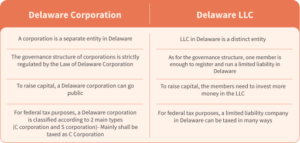

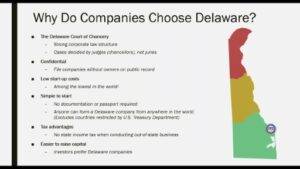

Delaware has long been a favored destination for business formation due to several key advantages:

- Business-Friendly Laws: Delaware’s legal framework provides a favorable environment for businesses. The state has a well-established body of corporate law that is consistently updated to meet the needs of modern businesses.

- Tax Advantages: Delaware offers significant tax benefits for businesses. Corporations that do not conduct business within the state are not subject to state income tax.

- Well-Established Corporate Environment: The state boasts a rich ecosystem of service providers, including registered agents, law firms, and financial institutions, which can facilitate the process of business formation.

- Court of Chancery: Delaware’s Court of Chancery is a dedicated court system that specializes in business disputes. This court is known for its expertise in corporate law and its efficient resolution of business-related matters.

Considerations Before Proceeding

While Delaware offers many advantages for businesses, it’s crucial to carefully consider a few factors:

- Physical Presence: If your business primarily operates in a different state, you may still be required to register as a foreign entity in that state.

- Annual Franchise Tax: Delaware requires all businesses registered in the state to pay an annual franchise tax. This tax is calculated based on the type and size of the business.

- Legal and Financial Advice: Consulting with legal and financial professionals who are well-versed in Delaware business laws is highly recommended to ensure compliance and make informed decisions.

Choosing Delaware as the home for your business can be a strategic move, offering numerous benefits and opportunities for growth. However, it’s crucial to start with a solid foundation, beginning with a thorough Delaware Business Entity Search. By following the steps outlined in this guide, you can embark on your entrepreneurial journey with confidence and clarity. Remember, seeking professional advice when navigating the intricacies of business formation is always a wise decision. Good luck on your Delaware business venture!